Shares for the future: this business is heading for the exit

Analyst Richard Beddard’s latest score tells us this is not the kind of business he’s looking for. Here’s why he’s seeking a replacement to improve his Decision Engine.

4th October 2024 15:17

This week it is Cropper (James) (LSE:CRPR)’s turn to be scored. It published its annual report back in July, but I have been putting it off.

My review will be brief, because it is probably the last time I score the company for a while. I do not intend to keep the venerable papermaker-turned-enabler of the hydrogen economy in the Decision Engine.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

James Cropper is not the kind of strong, gradually evolving business that I think can be easily analysed. The paper-making side of the business lost its way years ago.

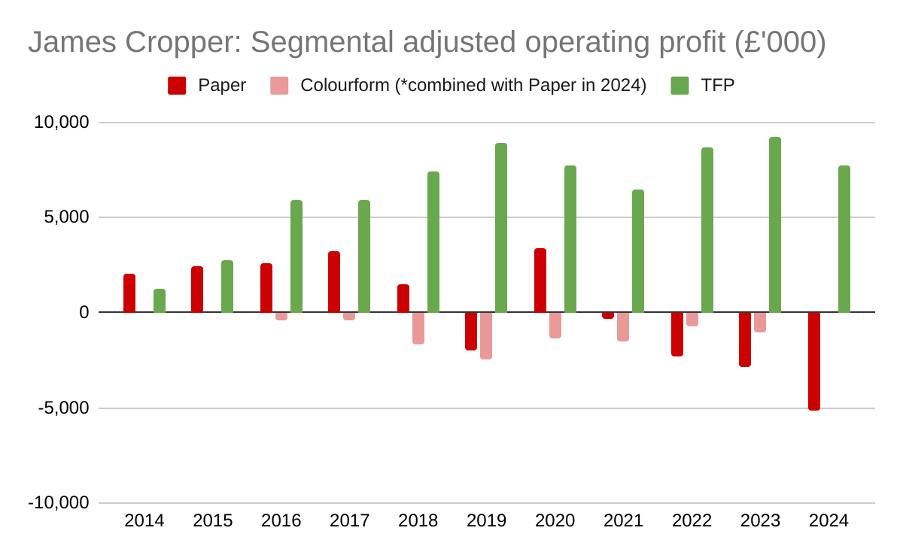

Paper is a commodity, and the company has yet to find the answer by focusing on luxury paper and packaging products (red and pink bars in the chart below. Colourform, a start-up luxury packaging business that has never made a profit, was rolled into the loss-making paper business in 2024).

The profitable advanced materials businesses (green bars), which grew out of James Cropper’s expertise in technical fibres produced in a similar way to paper, has bet on the hydrogen economy. These businesses sit in the Technical Fibre Products segment (TFP).

TFP has long supplied a kind of carbon paper that is a component in the critical gas diffusion layer (GDL) of hydrogen fuel cells that may power the cars and trucks of the future.

In 2021, TFP also acquired the capability to make coatings for components in hydrogen electrolysers. These machines make hydrogen from water by splitting it from the oxygen.

But major infrastructure projects that will drive demand for hydrogen electrolysers and fuel cells have been delayed by rising costs and reduced funding. This has had a knock-on effect on demand for components all the way down the supply chain to James Cropper, which was scaling up manufacturing to meet demand that will now not materialise until the period between 2026 and 2028.

The figures for James Cropper’s two segments, and in the summary below are adjusted, and they present a best-case scenario.

As you can see, it is not pretty.

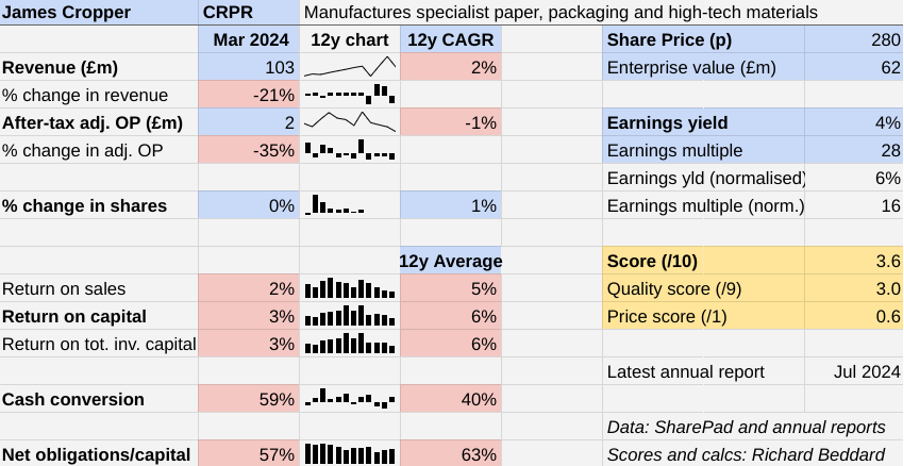

Despite all its endeavour, James Cropper has not grown revenue or profit convincingly over the last 12 years. In the year to March 2024, both fell dramatically. Adjusted after tax operating profit and return on capital were half the modest averages the company has achieved.

If we count £2.4 million in restructuring costs in 2024 as the Paper division shed 15% of its staff, and the £4.4 million in fixed assets written off, James Cropper made a loss.

Financial obligations including bank debt are substantial. To reduce the likelihood of breaching its covenants the company has negotiated a temporary loosening. It also has a large defined benefit pension obligation.

- Stockwatch: buying for income after a profit warning

- Best and worst UK shares in Q3 2024

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

As I wrote last year, James Cropper is investing from a position of financial weakness. Now it has reduced investment because it will not be needing more hydrogen electrolyser capacity as soon as it thought. What it needs now, in fact, is cash.

To patiently wait for James Cropper’s hydrogen investment to pay off, we need to be confident in two things. That the hydrogen economy James Cropper imagines will come in the form it imagines it, and that James Cropper will have the financial resources to supply it.

A turnaround in the Paper businesses would help.

On all three counts I feel profoundly ignorant.

This year’s score should, therefore, be taken with a pinch of salt. All it really tells us is that it is not the kind of business I am looking for.

Scoring James Cropper: still haven’t found what I’m looking for

That is a shame, because in some ways it is! James Cropper’s history as a paper maker goes back centuries. One bit of James Cropper, the bit of TFP that makes technical fibres for a wide variety of industries is still growing profitably.

Members of the founding family are major shareholders and still sit on the board. Often the long-term, generational mindset of family members aligns their interests with long-term shareholders.

But management at James Cropper is not delivering returns for shareholders, and these must be stressful times for employees.

The Past (dependable) [0]

- Profitable growth: Company has not grown [0]

- Strong finances: Financial obligations are high [0]

- Through thick and thin: Return on capital is routinely below 10% [0]

The Present (distinctive) [1.5]

- Discernible business: Paper is commoditised. Niche TFP business [0.5]

- With experienced people: Family ownership not reassuring [0.5]

- That creates value for customers: Specialist know-how in TFP [0.5]

The Future (directed) [1.5]

- Addressing challenges: Competition, growth [0.5]

- With coherent actions: Focus on luxury paper, hydrogen bet [0.5]

- That reward all stakeholders fairly: Stressful times for employees and shareholders [0.5]

The price (discounted?) [0.6]

- Maybe. A share price of 280p values the enterprise at about £62 million, 16 times normalised profit.

A score of 3.6 implies James Cropper is risky.

It is ranked 39 out of 40 shares in the Decision Engine.

I think removing James Cropper would improve the Decision Engine, so I am looking for a replacement.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

PZ Cussons (LSE:PZC) and Renishaw (LSE:RSW) have published annual reports and are due to be re-scored.

PZ Cussons remains at the bottom of the table pending that re-score (probably next week). The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

10.0 | ||

|

2 |

Imports and distributes timber and timber products |

9.0 | ||

|

3 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

4 |

Supplies kitchens to small builders |

8.5 | ||

|

5 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.4 | ||

|

6 |

Distributor of protective packaging |

8.4 | ||

|

7 |

Flies holidaymakers to Europe, sells package holidays |

8.0 | ||

|

8 |

Manufacturer of scientific equipment for industry and academia |

8.0 | ||

|

9 |

Manufactures/retails Warhammer models, licences stories/characters |

7.8 | ||

|

10 |

Whiz bang manufacturer of automated machine tools and robots |

7.7 | ||

|

11 |

Manufactures computers, battery packs, radios. Distributes components |

7.7 | ||

|

12 |

Surveys and distributes public opinion online |

7.7 | ||

|

13 |

Manufactures filters and filtration systems for fluids and molten metals |

7.6 | ||

|

14 |

Designs recording equipment, loudspeakers, and instruments for musicians |

7.5 | ||

|

15 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.5 | ||

|

16 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.3 | ||

|

17 |

Sources, processes and develops flavours esp. for soft drinks |

7.3 | ||

|

18 |

Manufactures military technology, does research and consultancy |

7.3 | ||

|

19 |

Sells hardware and software to businesses and the public sector |

7.2 | ||

|

20 |

Distributes essential everyday items consumed by organisations |

7.2 | ||

|

21 |

Sells promotional materials like branded mugs and tee shirts direct |

7.0 | ||

|

22 |

Translates documents and localises software and content for businesses |

7.0 | ||

|

23 |

Manufactures natural animal feed additives |

7.0 | ||

|

24 |

Manufactures vinyl flooring for commercial and public spaces |

6.9 | ||

|

25 |

Operates tenpin bowling and indoor crazy golf centres |

6.7 | ||

|

26 |

Online marketplace for motor vehicles |

6.6 | ||

|

27 |

Online retailer of domestic appliances and TVs |

6.6 | ||

|

28 |

Supplies vehicle tracking systems to small fleets and insurers |

6.6 | ||

|

29 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

6.5 | ||

|

30 |

Retails clothes and homewares |

6.3 | ||

|

31 |

Acquires and operates small scientific instrument manufacturers |

5.9 | ||

|

32 |

Manufactures sports watches and instrumentation |

5.8 | ||

|

33 |

Publishes books, and digital collections for academics and professionals |

5.8 | ||

|

34 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.8 | |

|

35 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.6 | ||

|

36 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

37 |

Makes marketing and fraud prevention software, sells it as a service |

4.9 | ||

|

38 |

Runs a network of self-employed lawyers |

4.7 | ||

|

39 |

James Cropper |

Manufactures specialist paper, packaging and high-tech materials |

3.6 | |

|

v Frozen v | ||||

|

na |

Develops and manufactures hygiene, baby, and beauty brands |

6.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks