Stockwatch: buying for income after a profit warning

This small UK company trades on a modest valuation and pays a generous dividend, but has just suffered a hiccup. Analyst Edmond Jackson likes the odds of success.

4th October 2024 13:13

My last piece cited various profit warnings materialising - especially among smaller companies, which tend to be relatively sensitive. The macro context is two years of high interest rates still bearing down on the economy despite stock prices looking forward to rate cuts; hence downside risk if trading updates disappoint.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

It is most likely why the Bank of England governor has changed tune from expressing concern about stubborn UK services industry inflation, to saying the central bank could become “a bit more aggressive” in cutting rates, provided the news on inflation remains good. At least UK authorities are becoming aware how they have been talking down the economy, hence business and consumer confidence falling.

Consensus is now for the Bank to trim rates from 5.0% to 4.75% in November; the governor citing a potential spoiler if there is disruption to Middle East oil supply. Recalling the early 1970s, Arab nations jacked up oil prices as punishment for the West supporting Israel in the Yom Kippur war against Egypt.

Personally, I find it hard to believe Israel would target Iran’s oil infrastructure - as one analyst mooted this week - causing huge damage to Israel’s Western allies if oil prices double and more.

But it is a reminder how prospects are not necessarily as rosy as implied by the recent mood in financial markets.

Is a warning in plant hire significant this time?

I pick on an implied 10% profit downgrade at equipment rental group Vp (LSE:VP.) as this company was confident about its full financial year to March 2025, when it last updated at annual results in June. Moreover, a new chief financial officer from last January bought an initial £20,000 worth of shares at 671p only last 13 August.

Plant hire can be a useful cyclical indicator, although as yet the damage to guidance appears to be the result of delays in a rail upgrade programme and ongoing soft demand from construction and housebuilding. Infrastructure is described as “supportive” with strong demand in transmission, water and civil engineering. Obviously, the water industry is in catch-up mode amid public criticism for neglecting standards. However, public sector “infrastructure” is becoming harder to interpret.

Labour initially entertained a boost in spending towards helping wider economic growth, but once in government and aware of fiscal realities, various projects are said to be under review.

- Stockwatch: buying this small-cap for its 9% dividend yield

- High-yield tobacco stocks: City has a new favourite

Vp shares dropped from around 670p to about 590p, and shares in this £230 million small-cap trades on a circa 20p spread. At this level, and if the dividend was to creep up as previously expected from 39p per share to 40p in respect of the March 2025 year, the yield would be 6.8%.

It would be prudent normally to be wary of a first warning from a cyclical company but, intriguingly here, earnings cover was expected to be around 1.8x, and Vp has a 30-year uninterrupted record. Even during Covid when many companies omitted dividends, Vp’s fell only from 30.5p to 25.0p in respect of the March 2021 year.

Mind, last March’s balance sheet had £6.0 million cash versus a circa £15 million cost of dividends in each of two years, although the cash flow profile is strong, generating initially near £100 million from operations, easing only to £90 million net. After £63 million was spent this last financial year to upgrade the fleet, significantly to meet green credentials, perhaps investment needs are softening, although the table does show material capital expenditure over years which rather compromises free cash flow.

Vp - financial summary

Year-end 31 Mar

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 249 | 304 | 383 | 363 | 308 | 351 | 372 | 369 |

| Operating margin (%) | 13.4 | 11.3 | 10.0 | 10.3 | 1.8 | 12.3 | 10.6 | 3.4 |

| Operating profit (£m) | 33.2 | 34.2 | 38.3 | 37.2 | 5.5 | 43.0 | 39.3 | 12.5 |

| Net profit (£m) | 23.7 | 24.4 | 25.8 | 18.6 | -4.6 | 25.5 | 23.0 | -5.3 |

| EPS - reported (p) | 58.6 | 61.0 | 63.7 | 46.2 | -11.6 | 63.8 | 57.8 | -13.4 |

| EPS - normalised (p) | 47.4 | 52.2 | 66.9 | 48.6 | -1.0 | 63.8 | 67.2 | 42.5 |

| Operating cashflow/share (p) | 155 | 158 | 197 | 211 | 265 | 192 | 166 | 227 |

| Capital expenditure/share (p) | 160 | 179 | 184 | 136 | 118 | 172 | 159 | 183 |

| Free cashflow/share (p) | -5.0 | -21.0 | 13.0 | 75.0 | 147 | 20.0 | 7.0 | 44.0 |

| Dividends per share (p) | 22.0 | 26.0 | 30.2 | 30.5 | 25.0 | 36.0 | 37.5 | 39.0 |

| Covered by earnings (x) | 2.7 | 2.3 | 2.1 | 1.5 | -0.5 | 1.8 | 1.5 | -0.3 |

| Return on total capital (%) | 13.2 | 9.8 | 10.7 | 9.1 | 2.0 | 11.6 | 10.3 | 3.6 |

| Cash (£m) | 15.1 | 18.2 | 29.0 | 20.1 | 15.9 | 13.6 | 11.1 | 6.1 |

| Net debt (£m) | 98.9 | 179 | 168 | 232 | 183 | 188 | 193 | 187 |

| Net assets (£m) | 137 | 154 | 169 | 170 | 153 | 167 | 175 | 153 |

| Net assets per share (p) | 342 | 385 | 421 | 423 | 381 | 415 | 436 | 381 |

Source: historic company REFS and company accounts.

So unless the UK is tipping into recession, a near 7% yield ought now to be supportive – obviously, unless the trading narrative deteriorates. Vp is also intriguing how its 73-year-old chair owns 50.3% of the business and there is no family to take up the reins as happened for example at another “controlled” smaller hire group - £235 million Andrews Sykes Group (LSE:ASY) If anyone did want to consider making an offer, a recession would be ideal timing.

What of the adage - beware a first profit warning?

Yet such reasoning is speculative and there is an old saying about avoiding stocks on a first profit warning, possibly even to sell them. Management here has already been outwitted by adverse change, relative to its June guidance and August share purchase by the finance director.

It all really depends on whether the UK economy muddles through. Vp has just recently been caught by late-stage effects of higher interest rates - now easing - where housebuilding especially ought to benefit from Labour policies. Sluggish issues in rail management may be industry-typical rather than reflective of the wider economy. There has been quite some unfortunate timing in how all this has conflated for a profit warning.

- Best and worst UK shares in Q3 2024

- eyeQ: an opportunity that only comes once a year

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Mind, if the Middle East conflict does widen to affect oil supply – and in a worst-case scenario, it is once again weaponised against the West’s support for Israel – we are being complacent only to consider domestic matters.

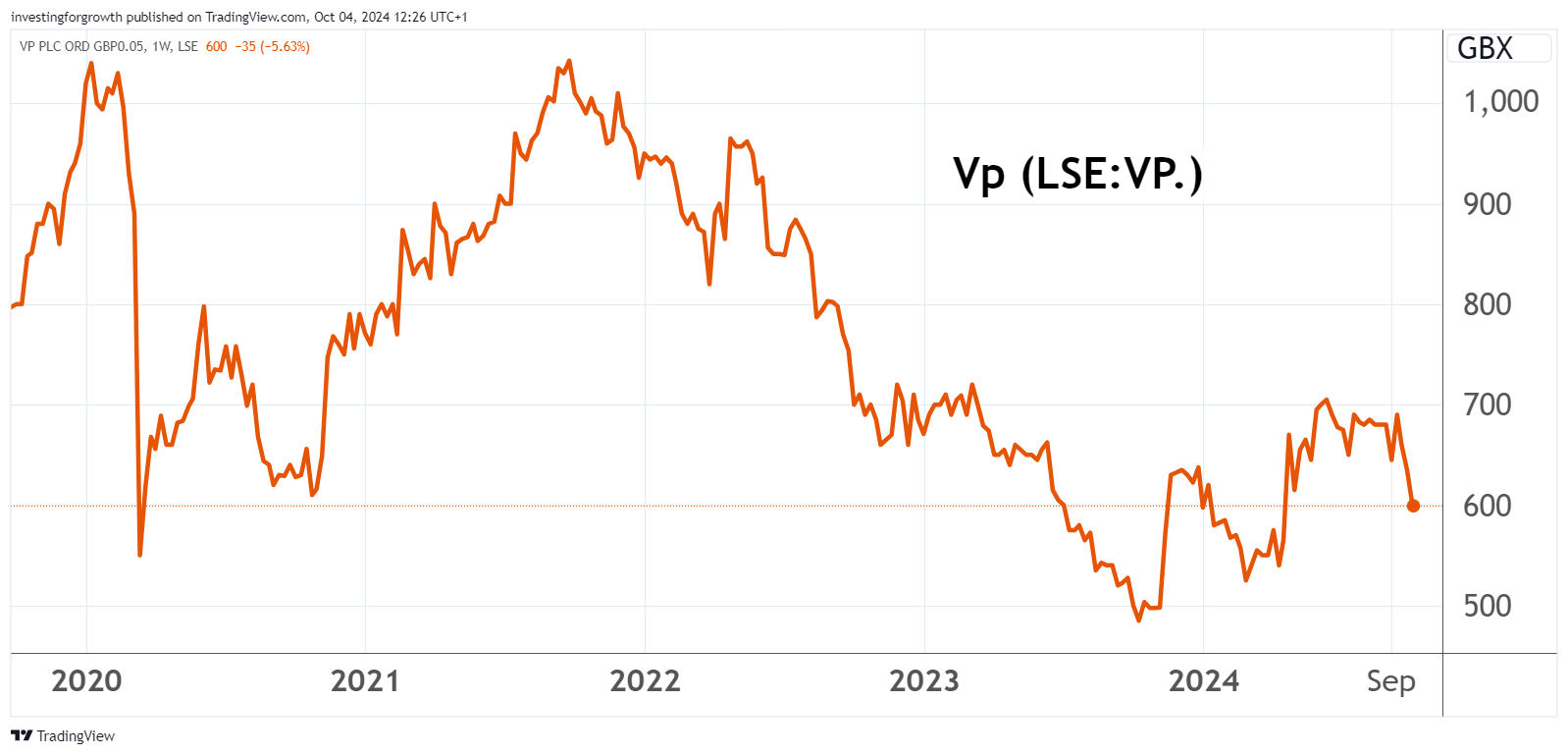

A see-saw chart is a deterrent to growth investors

While the long-term chart shows appreciation from around 150p in the 2008 crisis, Vp has spent the last decade in a circa 500-1,100p range, and the last five years reinforces the image of a stock to trade than hold:

Source: TradingView. Past performance is not a guide to future performance.

Not surprisingly then, management is trying to re-assert growth credentials by way of a declaredly “earnings-accretive” acquisition of Charleville Hire and Platform for an initial £10 million for a 90% stake, with the remainder subject to earn-outs over three years. This is one of Ireland’s “leading, specialist powered access companies servicing the growing pharmaceuticals, renewables, technology and food ingredient sectors”.

It looks more a bolt-on than anything transformative (albeit would raise risk) given it achieved 2023 pre-tax profit around £2 million equivalent, compared with Vp’s circa £77 million (adding back goodwill amortisation and exceptional charges) in its March 2024 year.

- Insider: four recovery bets plus FTSE 100 chief pockets £29m

- Share Sleuth: tempting stock is new addition to the portfolio

The timing is fortuitous lest some investors might feel despaired enough by the soft trading update, to sell, although I did notice some rather large trades yesterday, apparently motivated as sales.

Modest PE and useful yield, but risky

At 670p in June 2023, I examined Vp when guidance appeared to suggest a forward price/earnings (PE) multiple around 8x and a 6% yield. I concluded, “whether value truly exists, significantly depends on the UK’s economic trajectory, where Vp derives 90% of its revenue”.

I concluded how the case implied – if superficially – “buy” given a worse-case scenario of construction slump probably was only around 20% likely. The stock has since been sideways-volatile, even briefly below 500p a year ago. Chart analysis would say to be cautious; wracking wits over fundamentals having been quite futile. Back in June 2023, the chief concern appeared UK stagflation. Now it is massive international political risk. It’s tricky to predict, but you could argue in favour or respecting the chart.

I prefer a balanced approach and downgrade my normalised earnings per share target to around 65p in respect of the March 2025 year, implying a forward PE of 9x. There is material asset backing - 310p per share on a net tangible basis - if less comforting at near 600p to buy. Financial gearing is over 80% before £62 million leases, but at least Vp’s near £10 million annual interest charge should ease going forwards.

Vp is now a tricky one lest a worst-case economic scenario materialises. All-considered, I retain a “buy” stance” at around 600p, but avoid if you are already weighted towards cyclicals.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks