Squid Game: grisly lessons in how to manage your money well

13th October 2021 07:50

This ultra-violent South Korean Netflix series is THE hot show on TV right now, and its message can teach all of us something about the consequences of mis-managing your finances. Spoiler alert!

Source: Netflix/YOUNGKYU PARK

I have been watching Squid Game, the latest show on Netflix that has captivated worldwide audiences with its drama, uncensored violence - and, surprisingly, a wealth of money lessons.

The South Korean drama revolves around 456 people in debt participating in traditional children’s games - with a disturbing twist - for a chance to win 45.6 billion Won (around £30 million). We learn the main character, Seong Gi-hun, has overseen a number of failed business ventures after being made redundant and appears to be (initially, at least) an annoying gambler who steals from his mother, struggles to show up for his daughter and is in serious debt to loan sharks. Before long you are rooting for him and several other characters as they desperately work together to try to redeem themselves financially.

Debt has come to the forefront of our minds since a dramatic rise in energy bills, high inflation and the end of furlough are set to leave thousands of households facing the biggest squeeze on their finances in years.

- ii Top 10...things you need to know about inflation and your money

- Energy crisis: investor Q&A and share tips

- Five things investors must know about Britain’s energy crisis

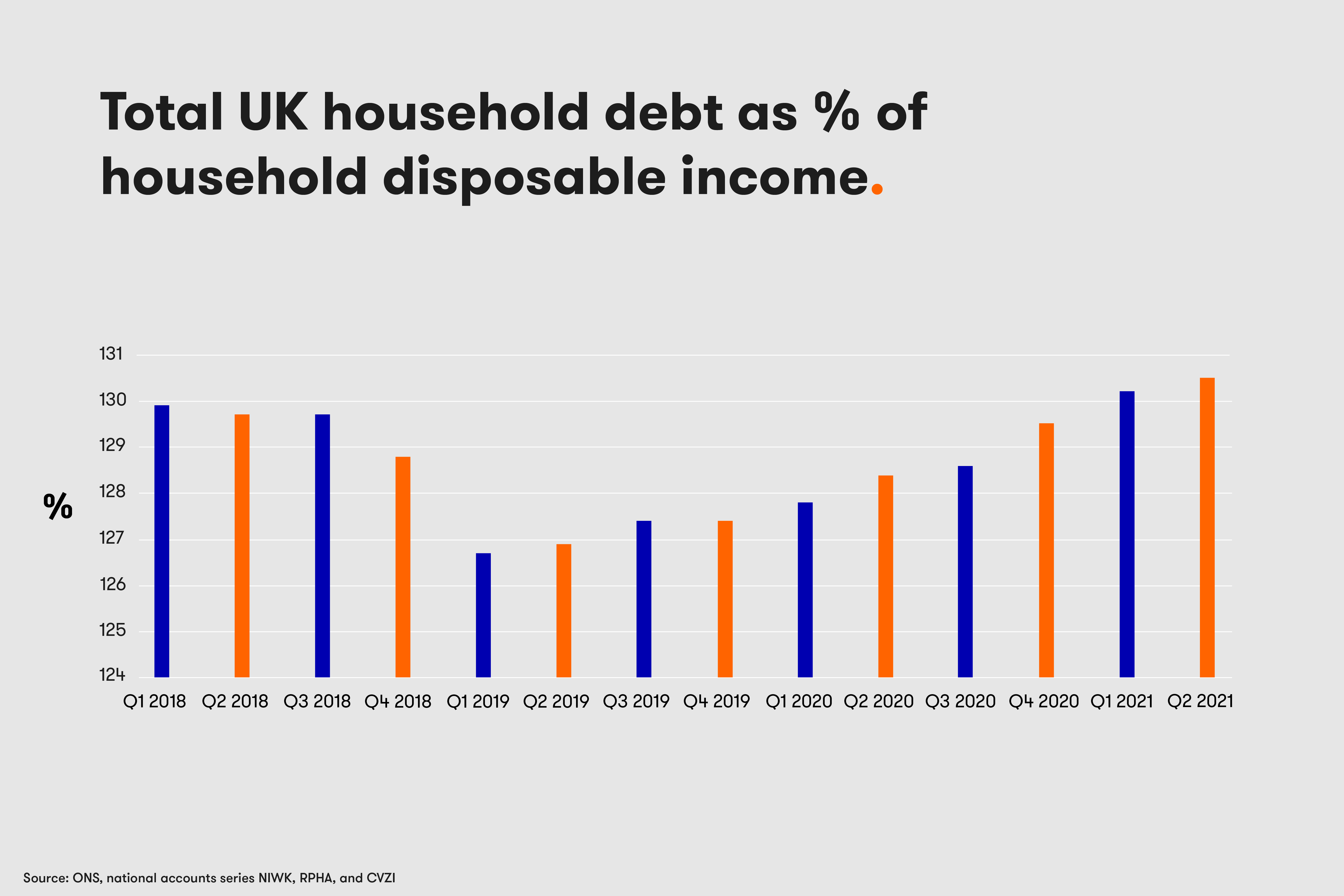

Many of us think debt won’t affect us. According to the Money Charity, the average credit card debt per household is £2,030 (July 2021). Meanwhile, the average total debt per household in July 2021 is £62,670, and latest figures from the House of Commons Library show UK household debt running at 130.5% of household disposable income in the second quarter of 2021. Even this doesn’t sound like the out-of-control debt levels that poor Gi-hun and his companions are dealing with.

However, rising inflation is chipping away at the purchasing power of your money. Throw in the substantial tax rises on their way and, before you know it, there’s a dent in your household finances even though you haven’t done anything unusual. All of a sudden you may find yourself taking on some debt - or increasing the amount you previously thought you were managing well.

While I highly recommend the show, you don’t have to watch Squid Game to reflect on your own household debt. Now is the time to manage your personal finances as well as possible.

Start with a rainy-day fund for emergencies, ideally three to six months’ salary in cash - although £1,000 is a good starting point. This will ensure that if your car requires repairs or your washing machine needs replacing you can easily access cash and won’t have to sell any investments during a potentially disadvantageous time.

- Low-cost investments to help get you started – all chosen by our experts

- Why you should invest regularly rather than all at once

- Mind & Money: understanding ourselves and our attitudes to risk

Second, prioritise paying off any credit card debt or unsecured loan - probably the most obvious money lesson in Squid Game. All the players choose to return to the game because they are in debt - and have missed opportunities to pay it off. Gi-hun, for example, wins big after betting on horses but decides to run away from his debt-collectors - only to have his winnings stolen.

Tackle the most expensive debt first. While it is important to have rainy-day savings, it isn’t usually a good idea to prioritise additional savings over reducing debts. Remember, debts cost more in interest than savings earn in interest.

Source: Netflix/YOUNGKYU PARK

Do not suffer in silence about debt. In Squid Game, we see several characters being harassed by all means about their debts and how scary it is, at one point discovering a torrent of phone texts from the authorities. Get support from one of the free debt charities such as StepChange and the National Debtline.

Once you are in a position to build wealth, it is necessary to take some risk. Keeping too much money in a low-interest savings account will be eroded by inflation. According to the 2019 Barclays Equity Gilt Study, the stock market has outperformed cash in 69% of two-year periods and 91% of 10-year periods. This is why investing money you don’t need (remember, money you need is in your rainy-day fund) in the stock market might be a good option. It can certainly give you a better chance of outperforming inflation and growing your money.

When it comes to investing, if it sounds too good to be true then it probably is. Huge, guaranteed or easy returns on a particular fund, stock, cryptocurrency or property do not exist. This may be the least obvious money lesson in Squid Game, where in the first episode the game’s salesman makes out that a simple phone call and a love of games are all Gi-hun needs to make serious money and clear his debts.

- Find out your financial personality type

- Want to learn more about the world of investing? Visit our Knowledge Centre

- Don't be shy, ask ii...how do I build an investment portfolio from scratch?

Another investing principle to stick to is to diversify - or “don’t put all your eggs in one basket” as Cho Sang-woo shrewdly declares before the Honeycomb game. Diversification means having a wide range of assets that perform differently, which spreads risk. It means that no matter how the economy is doing, some of your investments will thrive.

Finally, consider taking out income protection insurance, critical illness insurance or mortgage protection insurance. Squid Game highlighted that such a policy is another type of investment: a safety net that will maintain your standard of living should the worst happen. You couldn’t help but be moved when Gi-hun’s mother chose to leave the hospital, despite being in terrible pain with diabetes, because he couldn’t make the monthly policy payments.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks